Cambridge Family Enterprise Press, 2018

How Three Circles Changed the Way We Understand Family Business

A family business advisor sits with a founder and his two daughters in a conference room in Chicago, helping the family with an intense discussion they are having about the future of their family-owned brewery. The elder daughter works in the business. Neither daughter has shares in the family company. All three family members say they want what is best for the business and what is also fair to the three of them. But, for all of their agreement on principle, this discussion about future leadership, ownership and inheritance is getting testy and personal.

The advisor picks up a marker, goes to a flip chart, and begins to draw.

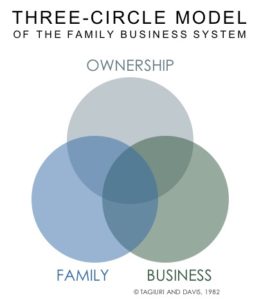

The circles he inscribes are a little wobbly, but that doesn’t matter. He labels the circles of the Venn diagram: Family, Ownership, and Business. He places each of the three family members in their appropriate sector of the diagram, and next to each of their names lists their interests and concerns. The diagram helps to clarify the roles and perspectives, and issues to be resolved.

What the advisor has drawn is the Three-Circle Model of the Family Business System, the fundamental framework in the family business field, created by Renato Tagiuri and John Davis at Harvard Business School (HBS) in 1978.

Two Circles Became Three Circles

Forty years ago, Tagiuri and Davis were looking for a framework to categorize the issues, interests and concerns they were hearing from Tagiuri’s executive students who led family companies. In 1978, Davis was a first-year doctoral student and Tagiuri, a senior professor of organizational behavior. Davis had a strong interest in family psychology as well as in business organizations. Tagiuri was a new faculty member in the Owner President Management (OPM) executive program at HBS, where most of the participants owned family companies. Tagiuri invited Davis to become his research assistant so they could both learn about family companies. It proved to be a very successful and enduring academic partnership that lasted over 30 years.

Over the next four and a half years, while Davis finished his doctorate, the duo conducted numerous interviews with family company owner-managers and surveyed hundreds of executive students on various family business topics. They met almost daily to discuss their projects and findings in the lounge of Humphrey House, Tagiuri’s office building on the Harvard Business School campus. They would take over the lounge for hours, spread their papers over the conference table, and discuss the latest survey or interview results.

“Renato would ask me, “What are we finding in this interview?” John Davis recalled. “I would explain the themes of the interview and the issues that I could spot. Then we would start diagramming the situation, trying to explain why this issue or that problem came about, and how the family influenced the business, and so on. Tagiuri drew circles, triangles, flow diagrams, and stick figures of fathers and sons (at that time there were few women in the OPM program, or in most family businesses).” Davis adopted diagramming as a way to express ideas, and continues to use this method to explain phenomena to students and colleagues. “We would go back and forth explaining whatever, and we came up with very solid understandings and some pretty wise recommendations for that time, like the need for governance to strengthen discipline among family members, although we didn’t call it governance back then.”

There was almost nothing in the literature to guide their exploration. Little had been written about any aspect of family businesses, and the only conceptual model of a family business system was a two-circle framework, which showed the family and the business as two overlapping systems or circles.

The Two-Circle Model recognized the influence of family and business on each other, and the need for alignment of family and business goals and interests. This model also made it easier to understand the confusion that individuals and the system could feel because of competing norms of the family and the business.

But for Tagiuri and Davis, even in the early stages of their work together, the two circles fell short of capturing the interactions and tensions they were seeing in the family business systems they were studying, from a fledgling retail operation owned and run by its husband-and-wife founders to a late generation manufacturing empire owned by cousins with many non-family executives.

So, they were on a hunt for a better framework. And it came several months after they began their research.

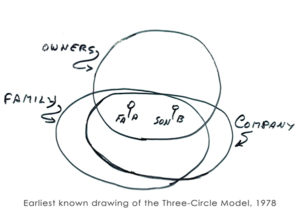

On this particular day in the fall of 1978, Davis reviewed a couple cases and Tagiuri took out his pen and drew two circles to represent the family and the business. “That’s part of it,” Davis remembers saying, “But in this system, they are fighting over getting shares in the company. Some of the family members are owners and some are not, and the two circles don’t account for that.”

Tagiuri thought for a moment. “Would this work?” he inquired, sketching out a third circle overlapping both of the first two, and labeling it Ownership.

“That’s it,” said Davis. “Some of these people are owners, some of them are family members, some are both. And some are also managers in the company. And this makes room for the people I am interviewing the most, the owner-presidents who are right in the center.”

Case by case, the pair started to work through specific family business cases to see whether these systems could be adequately described by the three circles. Husband and wife co-founders, Father-son companies, sibling partners, large cousin families with multiple branches, family managers actively running the business, owners and spouses who were not running the business, family employees who had not yet inherited ownership, young children in the family, relatives who had been bought out but were still in the family, non-family employees who were given minority shares, and even the anonymous public owners of listed family companies—all of them not only fit within the Three-Circle Model, their perspectives, goals, and concerns were better understood by it.

The addition of the third, ownership circle allowed more attention to be paid to other issues that were not explicitly recognized by the first two circles. Succession had to do with passing leadership and ownership. Some tough situations were resolved through buyouts of owners. Capitalizing a family business sometimes required bringing in outside owners. Linking the family, business, and ownership circles now fully defined the family business system, which is the integration of all three of these subsystems.

Elementary it may seem, but for forty years now academics, business families and their advisors have been sketching these three circles to gain insight into the inner workings of their family business and business family relationships. All family business systems can be described using the three circles, and each family business system can be uniquely understood with this framework.

It was this diagram (and the addition of the ownership circle) that also framed Tagiuri and Davis’s definition of family companies:

A family company is one whose ownership is controlled by a single family and where two or more family members significantly influence the direction and policies of the business, through their management positions, ownership rights, or family roles.

This definition could not have been derived without a three-circle perspective.

Three-Circle Model Explained

The Three-Circle Model of the Family Business System shows three interdependent and overlapping groups: family, ownership, and business.

An individual in a family business system occupies one of the seven sectors that are formed by these three overlapping circles. An owner (partner or shareholder) and only an owner will sit within the top circle. Family members will occupy the left-hand circle, and employees of the family company the right-hand circle. If you have only one of these roles, you will be in just one circle. However, if you have two roles, you will be in an overlapping sector, sitting within two circles at one time. If you are a family member who works in the business but has no ownership stake, you’re in the bottom-center sector. If you are a family member who works in the business and is an owner, then you will sit right in the center of the three overlapping circles.

“The Model identifies where key people are located in the system,” Davis explains, “and think about different roles that family members have: being a family owner, or a family employee. These overlap areas in the Model indicate role overlaps and potential role confusion.”

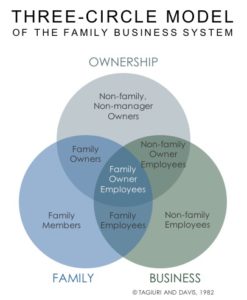

With the Three-Circle Model, one can depict seven distinct interest groups (or stakeholders) with a connection to the family business:

- Family members not involved in the business, but who are descendants or spouses/partners of owners

- Family owners not employed in the business

- Non-family owners who do not work in the business

- Non-family owners who work in the business

- Non-family employees

- Family members who work in the business but are not owners

- Family owners who work in the business

Each of the seven interest groups identified by the Model has its own viewpoints, goals, concerns, and dynamics. The Model reminds us that the views of each sector are legitimate and deserve to be respected. No one viewpoint is more legitimate than another but the different viewpoints must be integrated in order to set future direction for the family business system. The long-term success of family business systems depends on the functioning and mutual support of each of these groups.

Changing the Game

Sitting around the conference table in Humphrey House lounge on the Harvard Business School campus in the late 1970s, Davis and Tagiuri had no sense that they were inventing a game-changer. For starters, there wasn’t really a game to be changed: the study of family business was in its infancy. “There was not only little writing on these systems, there was almost no conceptual thinking on these systems.” Davis explains.

Their intentions were very immediate and quite pragmatic: As they doodled, they were simply trying to develop a useful tool. “We just needed something convenient to be able to organize our thinking about how these systems were structured. That’s all we needed to do at first.”

From those doodles, though, came a model that allowed for deep analysis of family businesses, and led to benefits that are both direct and wide-ranging.

Here are six often-noted impacts and consequences of the use of the Three-Circle Model.

- Family business academics and advisors the world over, have witnessed the transformative power of the Three-Circle Model. As Davis puts it, “Whenever I’m in a classroom helping MBA students get their arms around their system for the first time, my students will later tell me: When I saw the three circles, it all made sense.”

- The model of the family business system shows three overlapping circles or subsystems that are interconnected, which indicates that what happens in one circle influences the others. If one circle, say the family, is in conflict or stuck, it can pull down the performance of the other circles and stall out the development of the entire family business system. On the other hand, a high-performing business can create pride in a family and build unity in the ownership group.

- More than just indicating interdependence, the three-circles visually raise questions that beg for answers. The Three-Circle Model not only helps identify where in the family business system issues are occurring, but also helps to diagnose why issues have occurred or spread from one circle to another. Why are two owners so opposed to one another? To what extent has their estrangement stemmed from family difficulties, or differences that evolved in their business relationship? Would an ownership agreement help?

- The neutrality of the Model can help to defuse tensions in the family business system by illustrating the power of roles, rather than assuming differences are caused by personality differences. “One of the benefits of a more systems-oriented approach is that it alleviates some of the blaming that goes on,” Davis says. “People have told me that relationship tensions just made more sense after they saw where their relatives were located in the Model. For example, an owner-manager might observe: ‘My sister is always irritated at me because of the low dividends we pay. And I’ve been thinking, Wow, you’re so greedy. But when you see where she is in the system, it makes more sense. She doesn’t get a salary and benefits like I do working in this company. She doesn’t receive any of that.’”

- The Three-Circle Model explicitly recognizes the several interest groups or constituencies in the family business system. It becomes apparent that every group in the system has its own, legitimate interest in the family business, and all groups need to be respected, responded to and integrated in some way into the policies and decisions of the company.

- The Model also teaches us that the needs of the three circles, and of each interest group, evolve and change. The three circles are always in motion—never static. Families not only need to address their current challenges, but prepare for future challenges that they will likely face. Fortunately, the development of each circle over generations is fairly predictable. This realization led to the development of the Three-Stage Model of Family Business System Development (described in the book Generation to Generation: Life Cycles of the Family Business).

How One 5th Generation Family Conglomerate Used the Model

One 5th generation leader of a multi-billion dollar, family-owned conglomerate expressed the impact that the Model has had on his family’s understanding of their family business:

“A decade ago, we were in the midst of many challenges. Our values had become confused with our rules. Treating people with respect meant not firing anybody. Consensus meant that the scope for leadership was limited. Eventually these, and other issues, caused serious problems in the business. We had a governance crisis and a performance crisis, and closed one of our primary geographic regions’ operations.

That’s when we met John Davis, and the simple insight of the Three-Circle Model was revelatory. The fact that the circles are related but distinct, each with their own perspective, but linked, was illuminating. If one circle is unhealthy in its approach, it will affect the others. That was a significant shift for us.”

Withstanding the Test of Time

When so much in business, technology, wealth, family, and society has changed, how can a 40-year-old model still help us understand and manage issues in current family business systems?

Part of the reason why the Model has withstood the test of time, and is still relevant today, is that the Model, in its unaltered form, is adaptable. As the definition of “family” has changed in society, the Model allows for that. In-laws, blended families, divorce, adoption, domestic partners, and whoever the family calls a member of the “business family” because they are connected through ownership – all of these roles are consistent with the Model.

Likewise, the ownership circle can accommodate many possible scenarios. If a family business goes public or invites a private equity partner, the Model accommodates that ownership change. If the company issues different classes of stock (voting and non-voting), and holds some of the shares in a trust, the Model accommodates that. Today, as families have many different capital alternatives, the Model accommodates joint ventures, mergers, acquisitions, and different sources of capital that impact the ownership circle.

Many businesses have changed significantly in 40 years but the business circle of the Model is flexible: It may represent one business, or multiple businesses, holding companies, joint ventures and more. It can even describe a situation where the business family has sold its operating company and is managing their financial assets as an entity. The family is in a different business, but it is still their business. Similarly, the “business” circle can be labeled the “family office,” and the model still works.

With the pace of change, globalization, technological advancements, and disruption around the world, the changing environment will continue to shape businesses, ownership groups, and families. And the Three-Circle Model will continue to accommodate this evolution.

How About a Fourth Circle?

Like designing a three-wheeled car or adding a second story to an Eichler house, sometimes a classic design stays around because it simply can’t be improved on—given its purpose.

Over the years, many family business practitioners have sought to improve on the three circles. They have added more circles, and redrawn them as overlapping ovals. “Sometimes,” says Davis, “these models accomplish their purpose. But they tend to be complicated and not do as efficiently what the Three-Circle Model does.”

Davis himself has, over the years, tinkered with adaptations and additions to the three circles. “I played around for a while with the idea of having a fourth circle of wealth holders because in some situations the holders of family wealth differ from the owners of the family business. I wondered if we could try to map wealth holders distinct from owners. The fourth circle just didn’t work.”

Nothing seems to have the sticking power of the original Three-Circle Model. It is still the widely accepted, organizing framework used worldwide to understand family business systems. The acid test for the Three-Circle Model, Davis says, is this: “No one in the world now addressing family business issues doesn’t use it.”

Simplicity is central to the efficacy of the Three-Circle Model, Davis contends. “Models that have legs – that keep working – need to be simple enough to describe most of what you need to describe, and the Three-Circle Model does that.”

Expedient as it may be, even the Three-Circle Model has its limitations, and Davis is ready to concede that. “You know, it’s just a helpful tool and it’s not the only tool that you need.” He goes on to illustrate his point with another example. “We could describe your family business system using the Three-Circle Model. But your family also has a family vacation house, a family philanthropic foundation, financial investments that are managed collectively, maybe an art collection. All of these assets and activities influence one another and are important to your family but this collection isn’t captured by the Three-Circle Model. I created another framework for that, looking at the family enterprise system, which is a broader term than the family business system.”

A Three-Dimensional Future

So what lies in the future for the Three-Circle Model? Will we be using these same three circles in another forty years’ time?

“I think that the Model will still be the Model,” Davis says. “I think we will make more progress understanding how the family business system fits into the broader family enterprise system. I also think we will use the ability to map systems not in a two-dimensional way, but in a three-dimensional way. In my mind’s eye I can see three intersecting spheres and maybe being able to represent a family business system in three-dimensional space could allow some breakthroughs in understanding. But I don’t think somebody will come up with a fourth circle that compels people to do away with the three circles.”

The Three-Circle Model of the Family Business System was developed by Renato Tagiuri and John Davis at Harvard Business School, and circulated in working papers starting in 1978. It was first published in Davis’ doctoral dissertation, The Influence of Life Stages on Father-Son Work Relationships in Family Companies, in 1982. In 1996, the Family Business Review published it in Tagiuri and Davis’ classic article, “Bivalent Attributes of the Family Firm.”

_________________

Cambridge Family Enterprise Press, 2018

For permission to quote or distribute this article, contact [email protected]

All this may be why, for all his professed disapproval of the Lucky Sperm Club, Mr Buffett wants his son, Howard (pictured, left, with his son, Howard Warren Buffett, an academic) to succeed him as chairman, and guardian of the firm’s culture. The elder Mr Buffett is such a big fan of family firms that he likes to buy them: in October he bought Van Tuyl Group, America’s largest family-owned car dealership chain. As with LVMH and Kering, two family-run French luxury-goods giants that have bought a number of European fashion houses, Mr Buffett’s spiel to founding families is: if you want to sell up but want your business’s culture preserved, it will be in safe hands with us.

All this may be why, for all his professed disapproval of the Lucky Sperm Club, Mr Buffett wants his son, Howard (pictured, left, with his son, Howard Warren Buffett, an academic) to succeed him as chairman, and guardian of the firm’s culture. The elder Mr Buffett is such a big fan of family firms that he likes to buy them: in October he bought Van Tuyl Group, America’s largest family-owned car dealership chain. As with LVMH and Kering, two family-run French luxury-goods giants that have bought a number of European fashion houses, Mr Buffett’s spiel to founding families is: if you want to sell up but want your business’s culture preserved, it will be in safe hands with us.